🔥 This offer expires in:

🔥 This offer expires in:

321-312-0707

+1 000-000-000

The Ultimate Roadmap for Overcoming Debt

From Drowning in Debt to Financial Control in a few months—Without Living on Beans and Rice

Let’s be real:

Right now, it feels like your money disappears the second you get paid.

You’re stressed.

You’re juggling bills.

And no matter how hard you try… you can’t seem to make a dent in your debt.

The credit cards? Maxed out.

Your bank account? Always low.

And budgeting? Just makes you feel guilty and frustrated.

👉You lie awake at night wondering, “Will I ever feel free?”

👉You try to save, but one emergency sets you all the way back.

👉You’re tired of the shame, the stress, the fear of checking your bank balance.

The truth?

It’s not your fault.

No one taught you how to manage money — and everything you’ve tried so far hasn’t worked.

But that ends now.

Introducing…

📘 The Ultimate Guide to Debt Reduction & Financial Success

This isn’t just another budgeting book.

It’s a zero-fluff, real-world action plan to help you:

✅ Pay off debt — fast

✅ Stop living paycheck to paycheck

✅ And finally feel peace when you think about your money

Inside, you’ll discover the exact steps our author used to eliminate $30,000+ in debt — in less than 2 years — without feeling deprived or working 80 hours a week.

4.8 / 5 based on 1,236 reviews

JOE NORRIS

TEACHER & DAD OF 3

I was utterly lost dealing with the family budget and debt payments. I had no idea how the 'systems' truly worked but now it seems so obvious. Getting this full guide was a game changer and I saved the cost of it in one small change, plus now kick started my self education journey so I'm the one in control.

INTRODUCING - THE ULTIMATE GUIDE TO DEBT REDUCTION & FINANCIAL SUCCESS

If you're tired of debt piling up, credit scores tanking, and always wondering where your money went — this guide is for you.

✅ A step-by-step action plan to erase debt — fast

✅ Simple tools to slash your monthly spending by 20 - 40%

✅ Credit score hacks to fix your rating without paying shady “repair” services

✅ A low-stress way to build savings — even if you live paycheck to paycheck

✅ BONUS - A plug-and-play financial toolkit (trackers, calculators, planners)

No Gimmicks. No Fluff. Just a Real Plan That Works.

💡 Works even if you’ve failed with budgeting before

💡 No need to be a “numbers person”

💡 An easy and actionable roadmap

💡 No expensive software or financial advisors needed

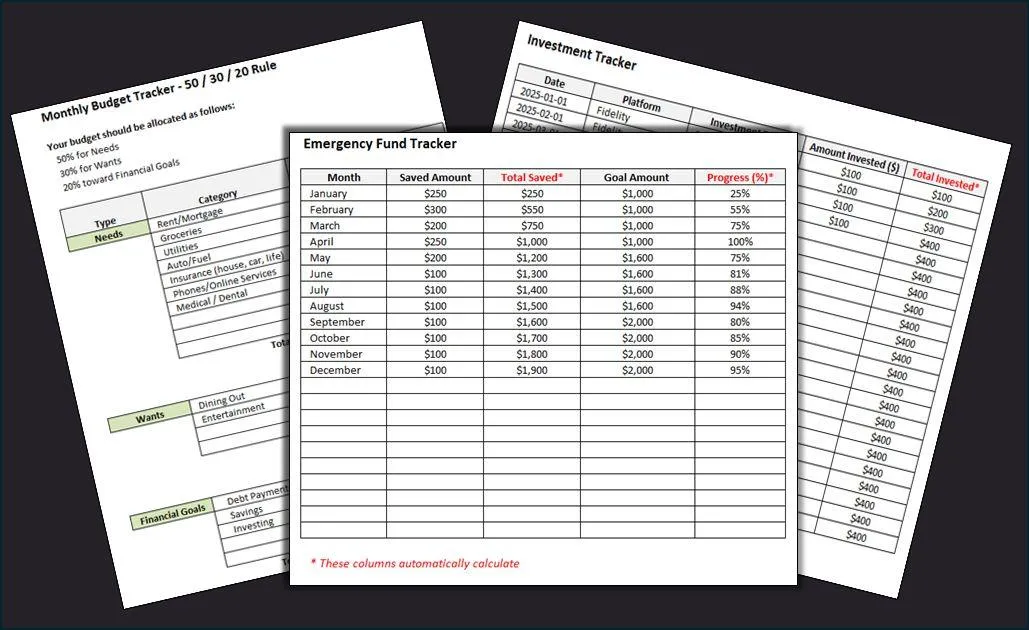

Free Bonus: Financial Toolkit

Monthly Budget Blueprint with the 50/30/20 model - just plug in your numbers

Debt Repayment Tracker - monitor & destroy your debt

Credit Score Jumpstart - tactics to boost your credit score fast

Emergency Fund Builder - Start with $20 and build your fund in a few months

Investment Launchpad - After paying down your debt, we provide actions for you to build investments

MORE THAN JUST A PDF

Knowledge is power. Introducing your new Superpower...

Right after your purchase, you'll receive the link to download this 8 Section Guide and the Free Bonus Financial Trackers... in just a few clicks!

Introduction & Creating Your Financial Roadmap

Here's the content in Section 1:

Intro: Using the guide effectively

Part 1: Understanding your financial situation

Part 2: Analyze your monthly cash flow

Part 3: The emotional and psychological impact of debt

Personal Finance Fundamentals

Here's the content in Section 2:

Part 1: Setting your SMART goals

Part 2: A proven budgeting framework

Part 3: Needs vs. Wants - how to reduce spend without feeling miserable

Part 4: Quick Wins - finding money to pay down your debt

Cutting Expenses & Boosting Savings

Here's the content in Section 3:

Part 1: Reducing household costs 20 / 40 / 60

Part 2: Identify the silent budget killers

Part 3: Avoid derailing your goals

Part 4: Lifestyle shifts that save big

Managing & Improving Your Credit Score

Here's the content in Section 4:

Part 1: How credit scores are calculated and why it's critical for you to know

Part 2: How to boost your credit score in just a few months and what not to do

Part 3: Build your credit while paying off debt

Getting Out of Debt - The Ultimate Action Plan

Here's the content in Section 5:

Part 1: Choosing a repayment strategy that works for you

Part 2: Extra income to fuel your strategy

Part 3: Know the truth about debt consolidation

Part 4: How to build a Mini-Emergency Fund to break the debt cycle

Building Your Emergency Fund - Your First Line of Financial Defense

Here's the content in Section 6:

Part 1: Learn why an Emergency Fund is essential

Part 2: Building your fund over 3 - 12 months

Part 3: How to automate the building of your Emergency Fund

Part 4: Where to keep your fund, and when you should use it and not use it

Building Financial Success - When & Where to Invest

Here's the content in Section 7:

Part 1: Develop your financial priorities

Part 2: Start with what you can afford

Part 3: Learn simple, proven investment methods

Part 4: How to automate your investing

Part 5: Understand the Power of Time and what to expect

Part 6: Learn how to avoid investment mistakes

Your Action Plan - The Roadmap to Permanent Financial Freedom

Here's the content in Section 8:

Part 1: 30-Day Reset Plan, your week by week plan

Part 2: The 6-Month Success Blueprint

Part 3: What to watch out for and avoiding the Debt Relapse

Get "The Ultimate Guide to Debt Reduction & Financial Success" TODAY For Just $19!

4.8 / 5 based on 1,236 reviews

Exclusive Bonuses Just For YOU!

Along with the Guide, get special bonuses that can help turbocharge your financial success. These extras are designed to complement your learning and give you an edge to manage in financial control. Act now to unlock these valuable tools!

BONUS #1: Monthly Budget Blueprint with the 50/30/20 model - just plug in your numbers

BONUS #2: Debt Repayment Tracker - monitor & destroy your debt

BONUS #3: Credit Score Jumpstart - tactics to boost your credit score fast

BONUS #4: Emergency Fund Builder - Start with $20 and build your fund in a few months

BONUS #5: Investment Launchpad - After paying down your debt, we provide actions for you to build investments

REAL PEOPLE, REAL SUCCESS

Join Our Community of Success Stories

Verified Review

CEMA PIRES

Kindergarten Teacher

"I always thought I was being smart—saving money, paying down debts... but this guide blew my mind. Turns out, there’s way more I could be doing to actually grow what I have. It’s crazy. I’m making moves now that I didn’t even know were possible. Already seeing the benefits, and it’s been worth every cent."

Verified Review

DAVID CHEN

Licensed Electrician

"Always wanted to take charge of my finances but felt like it was just... too much info out there, you know? This guide just lays it all out, step by step. Now my money’s actually working FOR me. One month in, I’m already seeing more reduction of debt than ever before."

Verified Review

EMILY REED

Freelancer & Mom of 2

"Bank fees, low interest rates... basically, my money was just stagnant. I didn’t even realize how much of a trap I was in till I read this. Just one of the decisions I’ve made from this guide saved me what it cost, honestly. It’s like I finally got control over my own money. Total game-changer."

Verified Review

ROBERT MARTIN

Self-employed entrepreneur

"I used to feel, well... totally clueless about investing and where to start. Then I got this guide, and boom—direction. It’s like having a road map for my money. My biggest regret? Not getting this sooner. Seriously, if you’re looking to break out of that paycheck-to-paycheck cycle, this is it."

Verified Review

JASMINE PATEL

College student & part-time worker

"People always say, ‘Just save your money!’ but no one ever tells you HOW to eliminate debt and live debt-free. This guide changed that. I can see the difference it’s making. For the first time, I’m actually excited about my situation!"

Verified Review

MICHAEL GONZALEZ

Online Marketing Advisor

"I’ve been stuck in the traditional income - debt loop for years, just assuming it was safe and smart. Wrong. This guide opened my eyes. I’m now actually seeing my debt being reduced. If you’re on the fence, get off it and grab this. It’s already paid for itself, trust me."

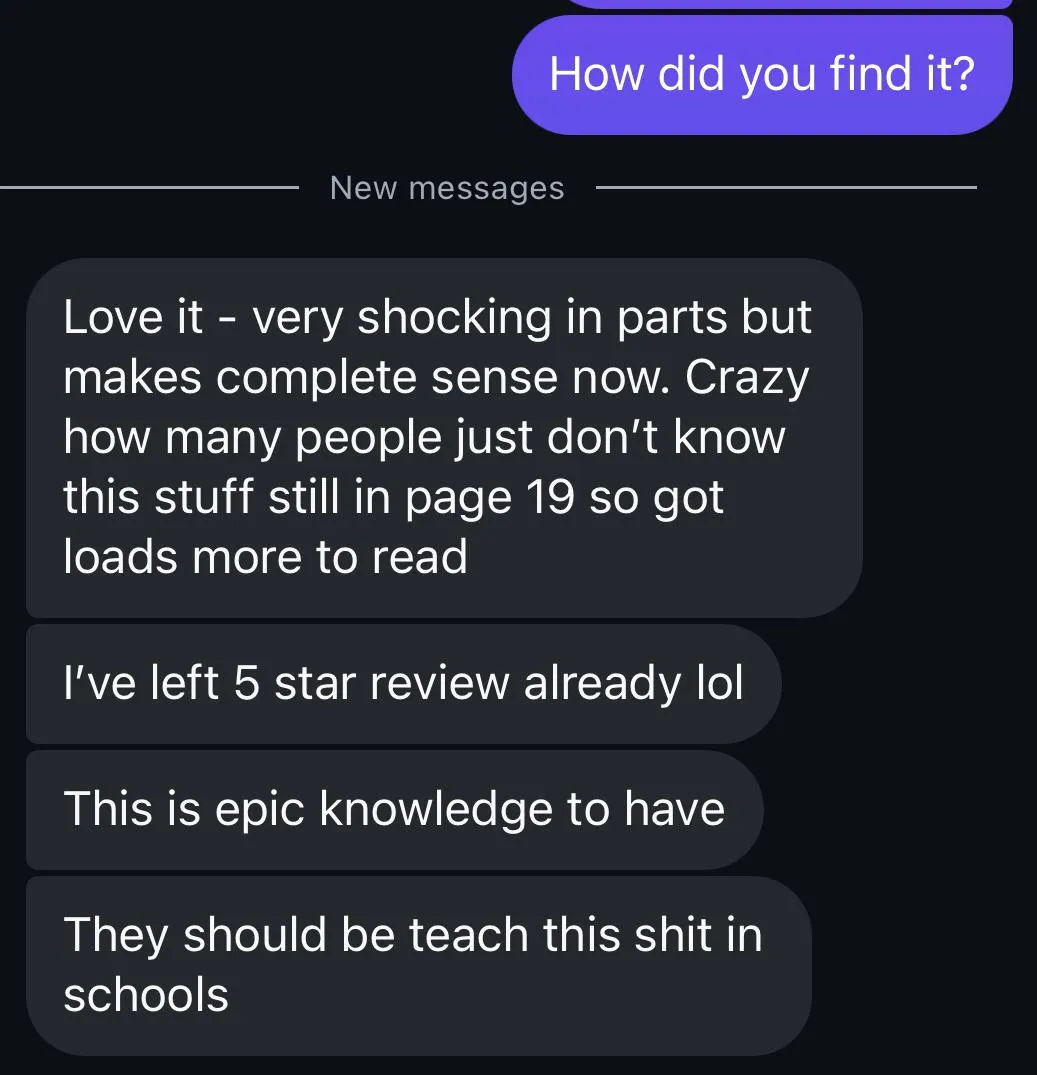

Want More? People Just Like You Send This Everyday...

4.8 / 5 based on 1,236 reviews

READY TO GET STARTED?

Get The Ultimate Guide to Debt Reduction & Financial Success PDF Today!

With the bundle, you gain immediate access to valuable resources on how to reduce debt and take control of your financial future. For a limited time, grab this comprehensive package at an unbeatable price. Don’t miss this chance to transform your future.

The Ultimate Guide To Debt Reduction & Financial Success PDF + Bonus Tracker Sheets

$19

4.8 / 5 based on 1,236 reviews

This 45 page guide, written by a Financial Planner, contains actionable strategies to develop your personal debt reduction roadmap

BONUSES INCLUDE:

Debt Reduction Tracker – See your balances shrink in real time

Monthly Budget Blueprint – Auto-calculate your money into Needs, Wants, and Goals categories

Emergency Fund Builder – Save your first $1,000 without cutting all the fun

Credit Score Jumpstart – Score improvement hacks

Investment Launchpad – Learn how to start investing with just $50 (after you pay down your debts)

Still Got Questions?

Here Are The Answers

What exactly will this guide teach me?

This guide walks you through what may be holding you back financially and introduces proven strategies for reducing personal debt. You’ll learn step-by-step how to make smarter financial decisions and how to reduce financial stress and live more free.

Do I need to make massive budget changes to realize results?

Not at all! Many of the strategies we share are suitable for any budget. You’ll learn techniques that you can start reducing debt slowly and accelerate over time.

How quickly can I see results?

Some changes, like reducing subscription services, can bring instant savings, while other debt reduction strategies work over time. With consistent action, you’ll likely see noticeable improvements within the first few months.

What resources come with the guide?

Along with the main guide, you’ll get tracking worksheets that can be used in Google Sheets (free) or in Microsoft Excel, if you have it. There are also recommendations for other free online tools designed to support you in taking action.

How is this different from free advice I can find online?

Great question! This guide brings everything together in one place, with actionable steps and strategies that are often scattered across multiple sources. We’ve condensed years of financial wisdom into a single, easy-to-follow guide to save you time and effort.

Is there a guarantee if I’m not satisfied?

While we can’t offer refunds on digital products, we’re confident in the value this guide brings. The strategies inside are designed to help you reduce debt and be more financially successful —many users report getting more than their money’s worth within days of implementing the strategies and tips.

4.8 / 5 based on 1,236 reviews

Copyright 2024 - 2025 AspireGuides. All rights reserved.

Disclaimer:

This guide is provided for informational purposes only and does not constitute financial, investment, or legal advice. The content is based on research and personal experience and is intended to share general information about financial concepts and strategies. Individual financial situations vary, and it’s important to consult a qualified financial advisor before making any investment or financial decisions. We do not guarantee specific results, and all investments carry risk. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.